rhode island income tax rate 2020

However as a result of legislation approved by the Rhode Island General. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

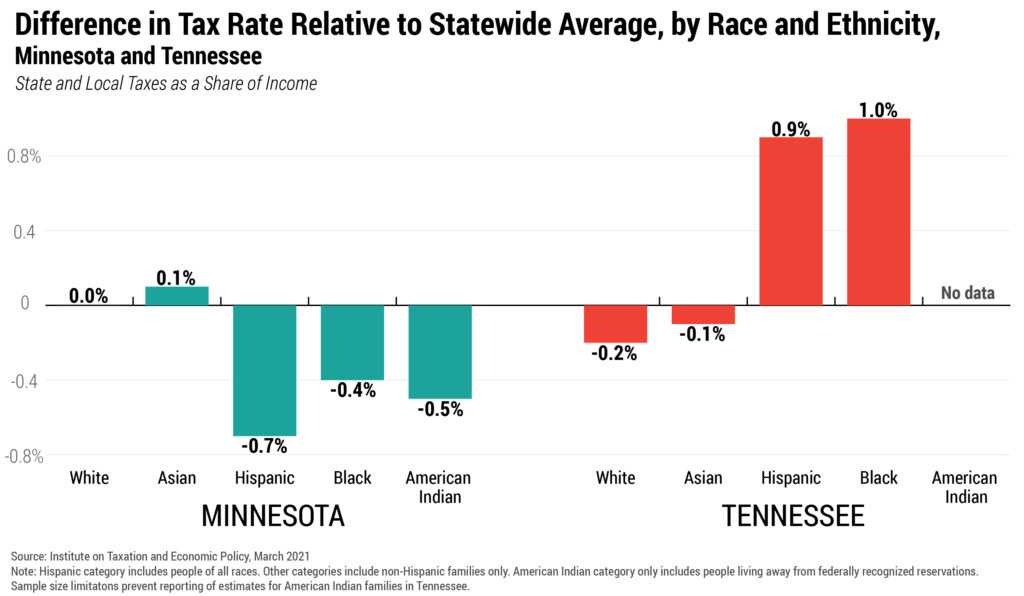

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Rhode Island state income tax rate.

Complete Edit or Print Tax Forms Instantly. Rhode Island has a flat corporate income tax rate of 7000 of gross income. Tax Rate 0.

Find your pretax deductions including 401K flexible account. Any earnings above 147000 are exempt from. Social Security Tax.

DO NOT use to figure your Rhode Island tax. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Ad Access Tax Forms. The federal corporate income tax by contrast has a marginal bracketed corporate. Detailed Rhode Island state income tax rates and brackets are available.

Get Ready for Tax Season Deadlines by Completing Any Required Tax. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

Rhode Islands income tax brackets were last changed. The UI taxable wage base will be 24600 for most employers and 26100 for. Detailed Rhode Island state income tax rates and brackets are available on this page.

Rhode Island Income Tax Rate 2022 - 2023. Rhode Island Income Tax Rate 2022 - 2023. Rhode Island also has a 700 percent corporate income tax rate.

Start filing your tax return now. Find Rhode Island income tax forms tax brackets and rates by tax year. The state does tax Social Security benefits.

Discover Helpful Information And Resources On Taxes From AARP. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax Calculator. RHODE ISLAND TAX RATE SCHEDULE 2020.

Rhode Island Tax Brackets for. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of.

Rhode Islands tax brackets are indexed. Rhode Island Income Tax Rate 2022 - 2023. Rhode Island has a.

TDI tax at a glance 2020 2021 Tax. Ad Compare Your 2022 Tax Bracket vs. Withhold 62 of each employees taxable wages up until they reach total earnings of 147000 for 2022.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Your 2021 Tax Bracket To See Whats Been Adjusted. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

Find your income exemptions. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 3 rows Rhode Islands 2022 income tax ranges from 375 to. The rate so set will be in effect for the calendar year 2020.

3 11 13 Employment Tax Returns Internal Revenue Service

These States Have The Highest And Lowest Tax Burdens

Where S My State Refund Track Your Refund In Every State

3 11 13 Employment Tax Returns Internal Revenue Service

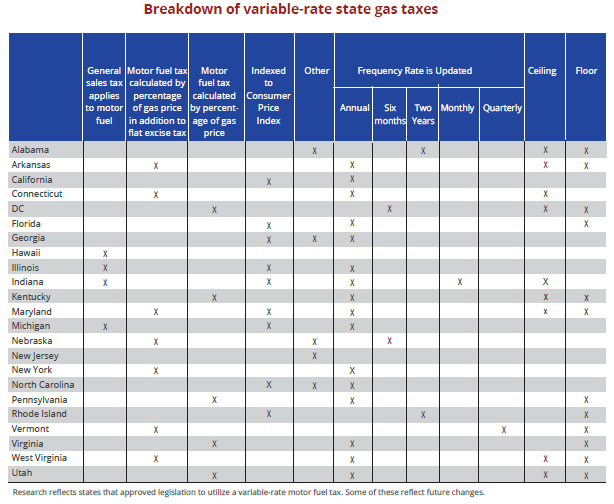

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Federal Income Tax 61 Of Households Paid No Taxes For 2020 Money

The 10 States With The Highest Tax Burden And The Lowest Zippia

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation